Written By Lexx Thornton

A federal judge has blocked a rule issued by the Consumer Financial Protection Bureau in January that would have removed unpaid medical debt from the credit reports of about 15 million consumers.

The ruling, issued Friday by Judge Sean Jordan of the U.S.District Court of Texas’ EasternDistrict, orders that the rule be vacated because of the court’s finding that the CFPB exceeded its authority under the Fair Credit Reporting Act. After the CFPB issued the rule in January, theCornerstone Credit Union League and the Consumer Data Industry Association, a trade group for the credit reporting industry, filed a lawsuit to halt it.

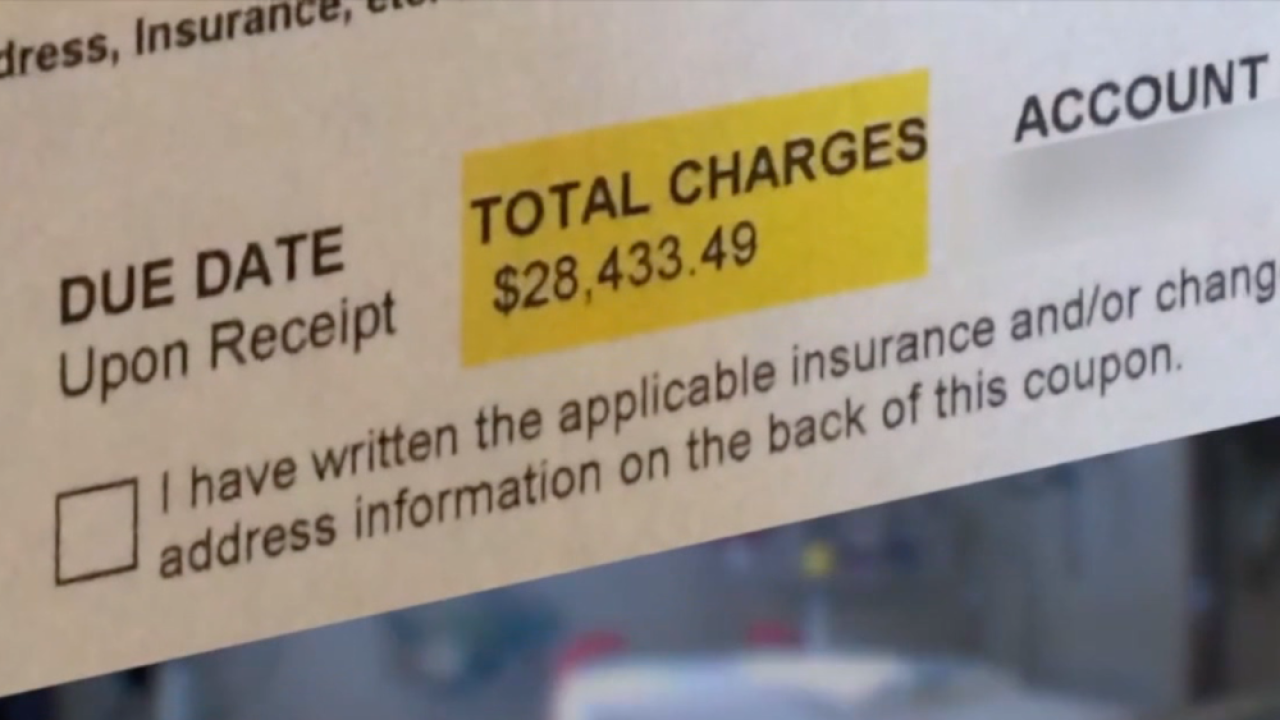

The court’s decision could impact the roughly 15 million people who carry a total of about $49 billion in medical debt on their credit reports, a burden that can influence whether lenders decide to extend loans like mortgages or auto loans to consumers. At the time when the CFPB issued the rule, the agency noted that medical debt is a poor predictor of whether a consumer will make good on other types of loans.

“It doesn’t show whether they are likely to pay their mortgage or other debts because there are a lot of inaccuracies and they have a lot of disputes,” Julie Margetta Morgan, former associate director of research, monitoring, and regulations at the Consumer Financial Protection Bureau, told CBS MoneyWatch.

Consumer advocates had hailed the CFPB’s rule for helping to protect consumers who can get tangled up in complicated issues around medical debt, such as problems with insurance reimbursements, denials, and other snafus.

“By pulling back on this rule, the court has eliminated the CFPB’s ability to provide that kind of relief to people and give this certainty that they can work with their health care provider to make sure the bills they are paying are accurate, without being hounded by a debt collector,” added Margetta Morgan, who currently serves as the president of The Century Foundation, a left-leaning policy think tank.

According to the CFPB, 20% of Americans have at least one medical debt collection account on their credit reports, while over half of the collections on credit reports are for medical debt.

In some states, consumers can rely on government protections to help them with medical debtand their credit reports, Margetta Morgan noted. Colorado and New York both enacted laws in2023 that provide some protections for consumers who have medical debt, for instance.

And last year, Experian, Equifax, and TransUnion, the three national credit reporting agencies, said that they were removing medical collections debt under $500 from U.S. consumer credit reports.

“From my experience reading these accounts from consumers, there are a lot of flaws in our medical billing and reporting system, and it lands in the consumer’s lap, and they are supposed to try to figure out how to deal with it,” Margetta Morgan said. “I would make sure the bills you receive are accurate,” as well as to check whether your insurer is paying the correct amount, she added