Civil rights activists and business leaders have asked President Joe Biden’s administration to include targeted funding for Black-owned businesses in the next Covid-19 relief package. They also say that without the federal aid many businesses could be forced to close their doors in the next 90 days.

Members of the National Urban League and the U.S. Black Chambers are among the groups demanding that Biden’s $1.9 trillion stimulus plan allocate money that will exclusively go to Black entrepreneurs.

“It should be specific,” said Ron Busby, president and CEO of U.S. Black Chambers. “It should not be minority, it should not be underserved, it should be Black.”

Their requests come as Black-owned businesses closed at disproportionate rates last year after entrepreneurs say they were rejected by banks for loans and overlooked in the first two rounds of Paycheck Protection Program (PPP) funding. According to the New York Federal Reserve, the number of Black businesses fell by 41% between February and April of 2020. White businesses fell by only 17%. Small businesses overall saw a 22% drop.

Black leaders say the disparity exacerbates the historic challenges Black entrepreneurs already face — including systemic racism in securing bank loans and accessing capital for their businesses. Black businesses have also closed at higher rates due to weaker cash positions. They are also more likely to be in Covid-19 hot spots and saw significant coverage gaps in PPP funding given the loans reached only 20% of eligible firms in states with the highest number of Black businesses, according to the New York Federal Reserve.

Recently, Black chamber leaders, including Busby, attended a virtual roundtable with Vice President Kamala Harris and Treasury Secretary Janet Yellen to discuss how the administration planned to help Black businesses devastated by Covid-19.

Harris and Yellen both acknowledged that little PPP funding went to Black businesses under former President Donald Trump’s administration. Biden’s recovery plan, Yellen said, would allocate $15 billion in “equitably distributed grants” to more than 1 million of the hardest hit small businesses, she said.

“This pandemic has exacerbated all the problems that existed before,” Yellen said.

During the meeting, Black leaders repeatedly asked Harris and Yellen if the stimulus package would include exclusive funding for Black businesses. Harris emphasized that the plan would benefit Black Americans while including targeted aid for all minority and women-led businesses.

Marc Morial, president of the National Urban League, said the Biden administration’s package is an improvement from what Trump offered. However, Morial said he is concerned Black businesses could still be neglected without specific provisions for them.

“We would like to see explicit targeting,” he said. “The idea is that Black businesses came to the pandemic thinly capitalized and already facing a range of challenges. Many have had to close because of no business, no savings, no reserve funds and no access to financing.”

Busby said most Black businesses didn’t qualify for the PPP loans because the aid was largely geared toward businesses that had a large staff or payroll budget. About 99% of Black-owned businesses are run by sole entrepreneurs, Busby said.

“I think it should be micro-business related,” he said of Biden’s Covid-19 relief package. “Those businesses specifically that have 10 of fewer employees.”

Busby said the Biden administration should also consider funding for Black Americans who lost their businesses last year and want to reopen them or lost their jobs and want to launch a start-up.

‘Every little bit helps’

Many Black entrepreneurs say federal funding from the Biden administration would help them keep their businesses open.

Bobby Ford, who owns BGF Bobby Q’s restaurant in Freeport, NY, said keeping his eatery afloat during the pandemic hasn’t been easy.

Last year, Bobby Q’s downsized to being only a takeout restaurant, losing all sales from dine-in customers as well as catering because people were no longer gathering.

He initially couldn’t get a bank loan and had to use his personal funds to sustain the business and pay his employees. In July, Ford received a PPP loan that helped keep the business open. Still, Ford says additional federal funding would provide more job security for his seven employees.

“Every little bit helps,” Ford said. “My workers, they still have bills to pay, so yes, that assistance greatly helps.”

Dwindling profits a strain on Chicago business owners

Steve Fulton, who runs a shoe shining business in Chicago City Hall, said he has lost so much business during the pandemic that he can’t pay his rent and relies on food pantries for his meals.

Fulton said he went from an average of 50 customers a day, making as much as $200, to no costumers at all some days. He hasn’t been able to get any grants to sustain his business. Fulton said he is pleading for the Biden administration to provide some relief for Black businesses.

“I see a lot of big businesses getting the PPP bank loans while we are being overlooked,” Fulton said. “The need for small Black-owned businesses to receive help is overwhelming.”

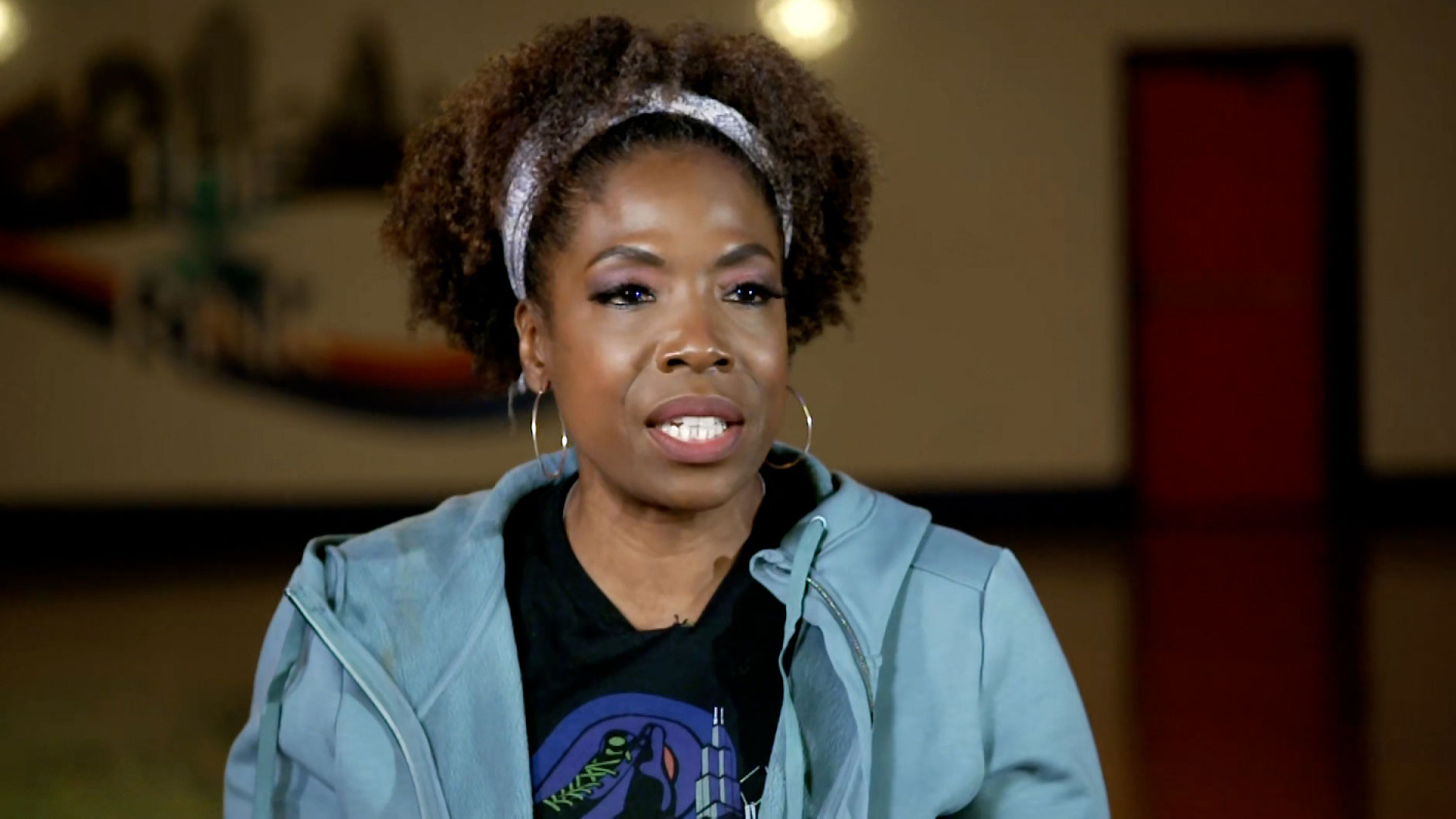

Ramona Pouncy is struggling to keep the doors open at a skating rink that once served hundreds of youth in Chicago.

Pouncy, owner of The Rink, said the pandemic has forced her to limit capacity and operating hours. The changes have resulted in a devastating blow to her revenue.

Pouncy secured a small business loan and grant last year, but it was only enough to pay her 14 employees and catch up on utilities.

“It’s been tough,” Pouncy said. “I mean if you go from 400 people in a building to nothing. And we still have 35,000 square feet of facility that we have to keep up.”

There are still bills to pay and she wants to ensure that her employees can still get paid. Pouncy said.

Atlanta restaurant forced to close

Some Black businesses couldn’t sustain Covid-19 restrictions, including social distancing measures, and closed within months of the pandemic hitting the country.

Simon Guobadia shuttered his popular Atlanta restaurant Simon’s last May.

Simon’s offered takeout meals under CDC guidelines for few months, but it didn’t bring in the same revenue as the dine-in operation. Guobadia said his restaurant was 7,000 square feet and it would not have been profitable to operate with limited capacity.

“It was not enough to sustain a business model like what we initially started to do,” Guobadia said. “And we were going to suffer in the long run.”