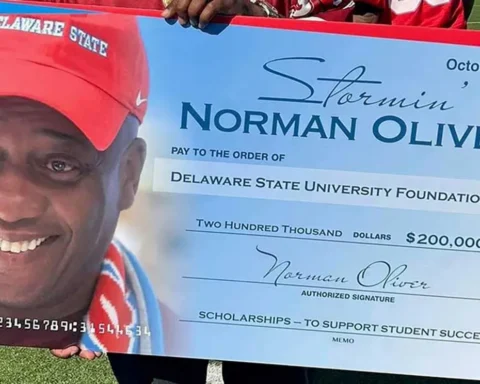

Courtesy of Delaware State University

A national expert on federal student loan debt relief programs presented important updates and information Thursday in a Delaware State University community Forum.

Guest Speaker Ashley Harrington, the senior advisor to the U.S. Department of Education’s Office of Federal Student Aid (FSA), offered details and tips during a 45-minute, information packed session, which is available for viewing here.

Ms. Harrington reviewed two federal programs that can reduce student debt, including the Public Service Loan Forgiveness (PSLF) program that has temporary time-limited changes and a recently announced, sweeping plan to reduce student debt for Americans considered middle or lower income.

Announced by President Biden in August, the student debt relief plan will forgive $10,000 in outstanding federal student loans for eligible families and individuals and up to $20,000 in debt relief for students who qualified for a Pell Grant. Individuals making less than $125,000 a year and households with a combined income of less than $250,000 will be eligible for debt forgiveness.

In his introduction, University President Tony Allen called the plan “the most far-reaching, comprehensive initiative on student debt relief in American history,” noting that 43 million Americans will be eligible for the funds.

Ms. Harrington said the application for the program will be released sometime later this month. Steps that students can take now in preparation include:

- Visit or create an account at www.StudentAid.gov.

- Confirm contact information is up to date.

- Sign up for program updates at www.ed.gov/subscriptions.

The application was kept simple, said Ms. Harrington, and will contain income verification and a couple of questions. People will be encouraged to apply by mid-November 2022 but have until the Dec. 31, 2023 deadline.

Ms. Harrington also reviewed the Public Service Loan Forgiveness Program, which was created in 2007 to help people enter professions considered to be a public good but which offer salaries that don’t cover student debt. As part of a limited PSLF waiver, borrowers may receive credit for payments that previously didn’t qualify. This opportunity ends October 31, 2022.