By Jessica Washington

Black Americans are drowning in student debt, and many of us struggle to keep up with the demands of paying off loans and saving for retirement. If you’re tired of choosing between dodging debt collectors forever and working until you croak, you might want to learn about this new retirement law.

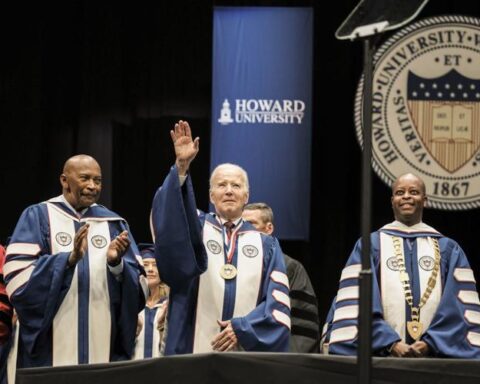

Biden recently signed the Secure 2.0 bill, which makes some pretty important changes to how Americans can save for retirement. The most notable change is that employers can now match what someone spends on their student loan payments with retirement payments.

The law goes into effect in 2024, but the implications are pretty astounding, especially for Black Americans who hold a disproportionate amount of this country’s student debt.

Black women, in-particular, carry a massive student debt burden. On average, Black women have more than $38,000 in student loan debt, according to Education Trust. And Black women with master’s degrees have over $58,000 in federal student loans.

Student loan debt can be a massive inhibitor for saving for retirement. According to the Boston College Center for Retirement Research, Bachelor’s degree holders with student debt at age 30 have significantly less retirement funds than people without student loans.

Making it so that people can simultaneously pay off their student loans and save for retirement could help close this gap.

However, one thing this law doesn’t solve, is the fact that many Black Americans, especially Black women, have employers that don’t offer retirement plans at all.

Geoffrey Sanzenbacher, an associate professor at Boston College and research fellow at the Center for Retirement Research, told DAME Magazine, that women of color are less likely than white women to be offered retirement plans through their employer.

This bill would not force companies to offer student loan matching programs or other types of retirement programs.

Helping more people save for retirement is obviously a great idea! But it’ll be worth watching how many employers actually take Congress and the White House up on this new initiative and whether the benefits reach the people who need it the most.