By Stillman College

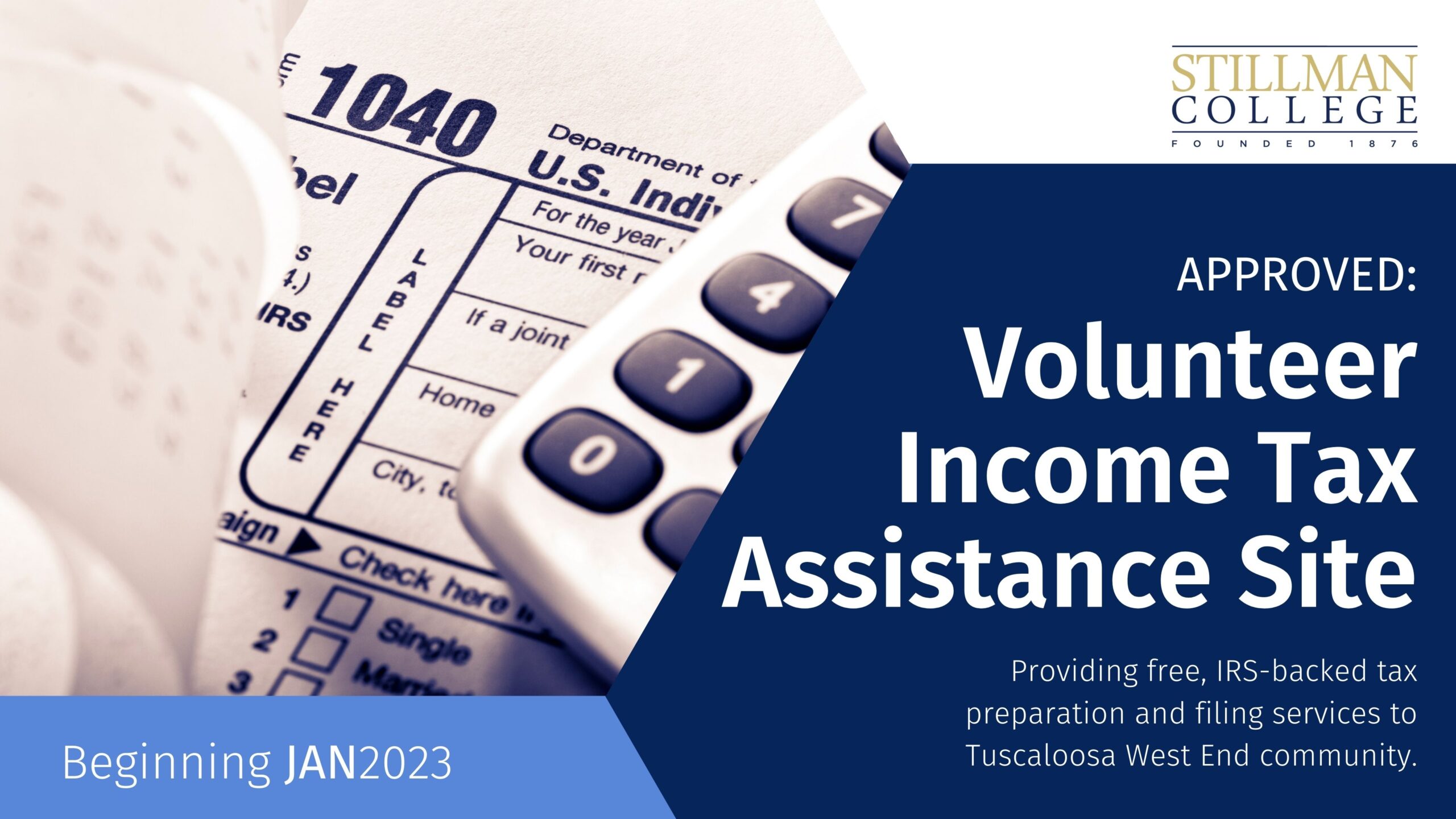

Stillman College will offer free tax preparation for the Tuscaloosa Community beginning January 2023.

Stillman College has been approved as a Volunteer Income Tax Assistance (VITA) site for the tax year 2022, a designation that will provide free tax preparation services and tax counseling for low-to-moderate income individuals and families.

Both the VITA and Tax Counseling for the Elderly (TCE) programs are Internal Revenue Service initiatives funded by congress. VITA and TCE are operated by volunteers in several thousand communities throughout the country. People who make $58,000 or less or have a disability are eligible for the VITA program.

Stillman’s VITA site will be a welcome and needed resource for Tuscaloosa’s West End, which has a median household income of under $26,000, according to the 2020 census.

Dr. Floran Syler-Woods, associate professor of accounting and data analytics at Stillman College, will oversee the VITA program. She said the community will benefit from trusted, IRS-trained preparers, proximity to the VITA site – Stillman’s campus – and an eagerness to serve the community, all of which help fulfill expectations residents have of Stillman.

“My main goal in coming to Stillman is to connect students with the community and the community with Stillman,” Syler-Woods said. “Stillman is a beacon of hope in the West End, and a lot of our resources are underutilized.

“We have excellent scholars studying accounting and business. It’s important that our students learn how to develop their talents and abilities and use them in service.”

At least 10 students and a handful of faculty members will staff the VITA site in the spring. Students will be trained using the IRS software by enrolling in ACC 434, a senior-level income tax course at Stillman taught by Visiting Professor Vincent Davidson, CPA. Additionally, students from other majors can opt into the training program offered outside of the ACC 434 course.

Students will begin training in late October. Both Syler-Woods and Davidson will complete IRS training over the next two months.

Students will benefit in several areas, from increasing their knowledge of tax law to building a stronger resume in the areas of community service and tax preparation experience.

Syler-Woods, a Certified Public Accountant who previously helped operate VITA sites in Atlanta, said Stillman students who prepare and file taxes through VITA will graduate with “very useful” skills and knowledge that they can leverage immediately upon graduation.

“When I started my CPA practice, I did a lot of taxes to help pay the bills before I got other clients,” she said. “Students will get a beneficial skill, something they could make money with eventually, if they needed to, and give back at the same time.”