Republicans are discussing an idea that has long been anathema within the party: a tax hike on the wealthy.

In a twist, members of the GOP are debating whether to allow tax rates to go up on top earners when major parts of the 2017 tax law expire at the end of this year as part of a massive bill to pass President Donald Trump’s agenda.

The issue has come up in private meetings among Senate Republicans as they grapple with how to limit the red ink and pay for other provisions of their party-line package, which includes additional funding for immigration enforcement and the military.

Sen. Kevin Cramer, R-N.D., confirmed that there has been “some” talk of higher tax rates for the wealthy in “free flowing” conference lunch meetings, saying he finds the conversation “interesting.”

“It’s just so fun to be a Republican these days, just to watch the transformation, where suddenly people are going — when you think about it, why do we worry so much about that?” Cramer said when he was asked whether he favors higher taxes on the wealthy.

“So whether it’s allowing them to go up a little bit or even lowering some of the other stuff more — there’s a populism growing in the party, even among those of us with powdered wigs,” he said.

The prospect of such a momentous shift is driven by a transforming electoral landscape, with Republicans attracting voters with lower incomes and without college degrees, while higher-income and college-educated Americans drift toward Democrats.

Voters earning $100,000 or more annually voted for Republican presidential nominee Mitt Romney by a 10-point margin in 2012, but they preferred Democrat Kamala Harris over Trump by 4 points in 2024, according to exit polls. Barack Obama won voters who made less than $50,000 per year by 22 points in 2012, while Trump carried them by 2 points last year.

Sen. Mike Crapo, R-Idaho, the chairman of the tax-writing Senate Finance Committee, kept the door open when he was asked whether he supports a higher top tax rate when the 37% level lapses to 39.6% after this year.

“I will listen to my colleagues. I haven’t made any decision,” Crapo told NBC News.

Steve Bannon, a senior White House official during Trump’s first term and an ardent MAGA enthusiast, espoused a populist perspective when it comes to taxation.

In an interview on another topic, Bannon, unprompted, touted higher taxes on the affluent. He said House Speaker Mike Johnson, R-La., “needs to focus on actually cutting spending dramatically and raising taxes on the wealthy.”

At a town hall event in southeastern Iowa on Tuesday, longtime Sen. Chuck Grassley, R-Iowa, was asked why Congress isn’t making billionaires pay more in taxes, a question that drew applause and cheers.

“This might surprise you that the list of possibilities we have on our working sheet that the members of the Finance Committee, and I’m a member of that committee, are going to discuss is raising from 37% to 39.6% in that very group of people you talk about,” Grassley replied.

But he added, “Now, that doesn’t mean it’s going to happen.”

Indeed, it’s far from clear Republicans will coalesce around the idea, with some in the party voicing firm opposition. That high-ranking officials and lawmakers are considering it at all is a sea change for a party that has long been committed to reducing taxes on high earners. An article of faith within the GOP is that the wealthiest Americans help create jobs and help raise overall living standards en masse when they are burdened with less taxation.

Sen. Ted Cruz, R-Texas, firmly rejected the idea of letting taxes go up on the highest earners when he was asked about the idea.

“I think it is a mistake to raise taxes, and I don’t believe Republicans are going to do that,” he said in an interview.

Appearing Tuesday on Fox Business, House Majority Leader Steve Scalise, R-La., criticized the idea of allowing a higher top tax rate.

“I don’t support that initiative,” he said.

Sen. John Cornyn, R-Texas, said he’s not sold on the idea of a higher top tax rate, saying such a move could hurt “businesses that end up paying business income on a personal tax return.”

Asked whether small businesses could get a carve-out in those instances, Cornyn said: “I don’t know. That’s an interesting question. I’m sure we can probably do anything we can agree to, but that would be my concern.”

In Trump’s first term, cutting taxes for the wealthy was a nonnegotiable pursuit, one that Republicans took a political hit for when they passed the 2017 tax law.

Within Trump’s orbit, a split is evident between populists who want him to tax wealthier Americans and more traditional Republicans who believe across-the-board tax cuts are a formula for broader prosperity.

John McLaughlin, a Trump pollster, worries that unless Congress passes an extension of the first-term tax cuts, Republicans risk losing their majorities in the House and the Senate.

Visiting the White House last month, McLaughlin gave chief of staff Susie Wiles poll results showing strong support for extending the tax cuts. McLaughlin’s firm conducted the poll for the U.S. Chamber of Commerce.

“I’ve had discussions with Susie Wiles that they need to get the tax cuts passed, because that’s how you defy the historic midterm losses,” McLaughlin said in an interview.

“The consequences of letting the Trump tax cuts lapse is the largest tax increase ever of over $4 trillion,” he continued. “If you don’t have a growing economy, it’s very difficult to win elections. And you saw both in Wisconsin and Florida that the Trump voters were staying home.”

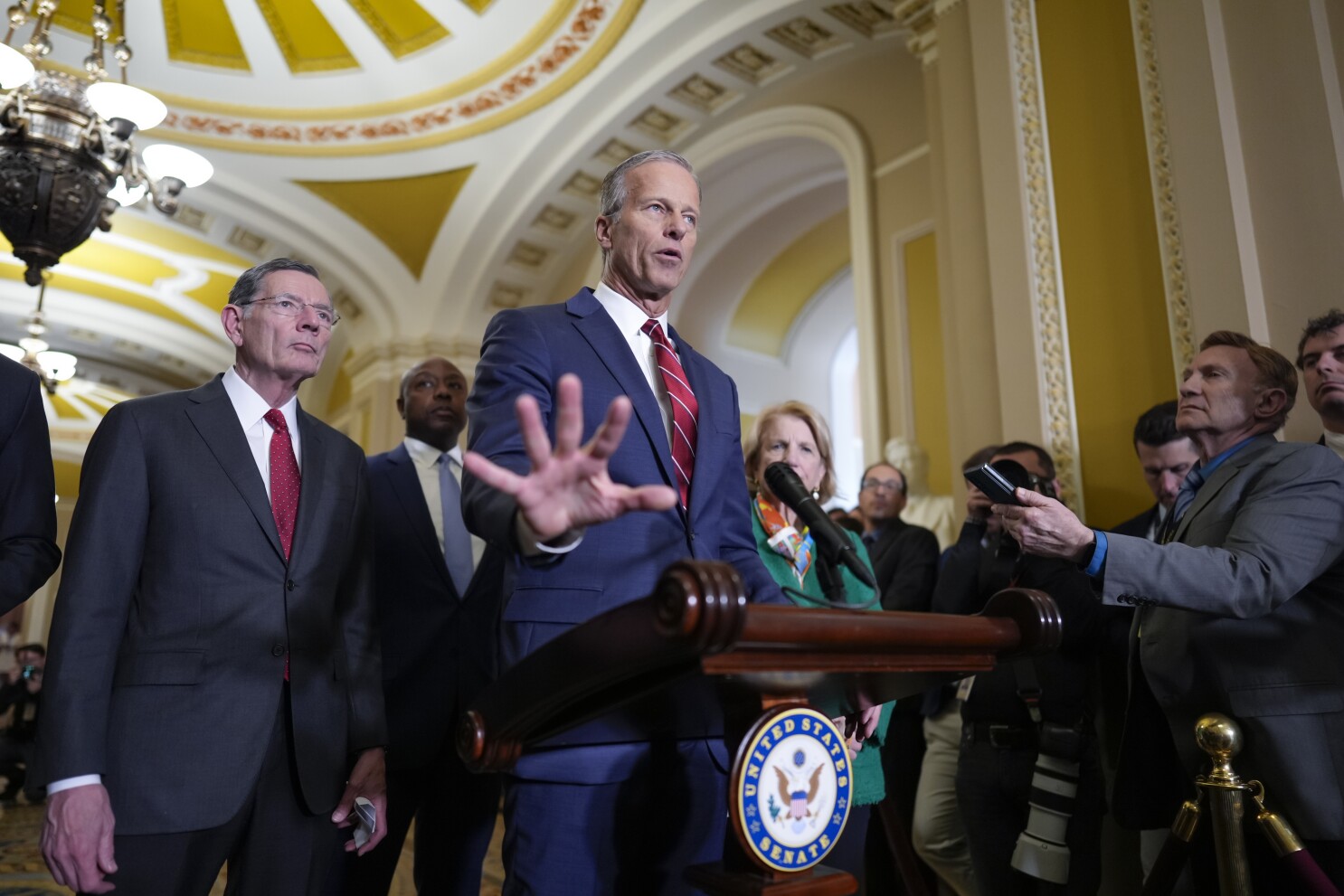

Senate Majority Leader John Thune, R-S.D., said a higher tax bracket for million-dollar earners has “been discussed.”

“I don’t know where that’ll land, but it’s something we would have to work closely with the House and with the White House on,” he said. “There’s a lot of stuff, a lot of proposals, flying around in the tax space. And in the end, we’ll have to find consensus, but the important thing is making sure that taxes don’t go up on the American people.”

Sen. Thom Tillis, R-N.C., didn’t endorse or reject a higher top rate, saying it’s a valid consideration given his belief in limiting the cost of the overall package.

“I do think that anywhere we have to create headroom for pay-fors, you got to look at it,” he said. “I’m not going to quote any numbers. I’m just saying at the end of the day, failure is not an option.”

Republicans say one way to square the idea of a higher top rate with the party’s long-standing opposition to tax hikes is to remember that on the first day of 2026, taxes will automatically go up.

“We’ve talked about a lot of different scenarios. That is one possibility,” Sen. Mike Rounds, R-S.D., said of a higher top tax rate. “The question is: Is it a tax hike or is it not a tax reduction?”