After third grade math teacher Shelby Lattimore delivered the day’s announcements, the “class banker” distributed everyone’s wallets — clasped envelopes decorated with animals, stars, hearts and cars scribbled in marker and filled with the faux money they’d earned this year.

Lattimore asked the class if they knew what inflating a balloon meant. They answered in the affirmative.

“I am inflating your rents,” she responded, drawing a chorus of grunts, complaints and “nos” throughout the poster-covered classroom.

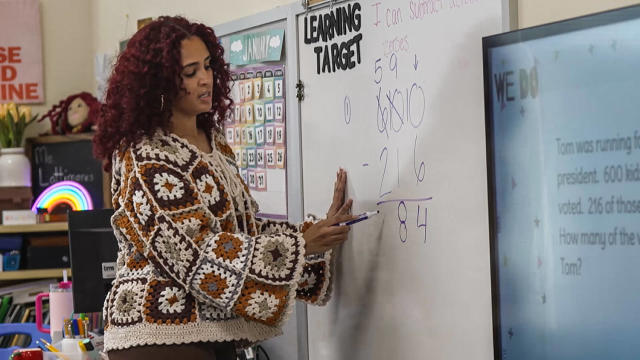

Lattimore has gone viral on TikTok and Instagram for her creative take on teaching financial literacy — using a classroom system that requires her students to pay rent for their classroom essentials, including their own desks.

Every week, viewers watch as her third grade math students collect “Miss Lattimore Bucks” for their classroom jobs.

“We have a teacher assistant, line leader, door holder, recess basket, lunch basket. We have a cleanup crew,” Lattimore said.

“All jobs do not get paid the same,” she said, “The jobs that are every day, like line leader and teacher assistant, like those jobs that you have to do something constantly, get paid more than jobs that are like every now and then or once in a while.”

At the end of the week, students collect their pay and have a decision to make: spend it or save it.

The exercise gives them some practical life skills for the real world, Lattimore said.

“Watching my students now become appreciative of possibly what their guardians are going through, of course in a safer environment, just kind of gives them that responsibility to then move forward as they become adults.”

Financial literacy, meaning having the skills and knowledge to make smart budgeting, saving, investing and other money decisions, is deficient among U.S. adults, according to some studies.

On average, adults correctly answered only 48% of 28 questions in the 2023 TIAA Institute-GFLEC Personal Finance Index, a survey that measures financial knowledge. That number was even lower for Black and Hispanic respondents, 34% and 38% respectively.

As a Black educator in a Charlotte school with a majority Black and Hispanic population, Lattimore said she hopes her classroom economy can help bridge the financial learning gap for her students.

“Charlotte is known for generational poverty,” Lattimore said. “A lot of my students of color, Hispanic, Black, whatever it may be, they see their parents, they see their guardian, they see their grandmothers, grandfathers, whatever, may be living check to check. They see the money management of not thinking long term necessarily and the consequences of it.”

Teaching children personal finance in an interactive way as Lattimore does is “highly effective,” said Ted Tucker, the executive director of Foundation for Teaching Economics, an organization committed to providing resources to students and teachers about the economy and personal finance.

“We believe that students need to do economics to better understand it. You know, instead of just listening to someone lecturing or talking about it,” Tucker said, “I think what games do or simulations do is they allow students to internalize the concepts that are being taught.”

“I think even at a young age, just getting a fair understanding of cost benefits is super important in our decision-making,” Tucker said.

In Lattimore’s class, students must “pay” $7 a week to rent their desk and chair.

“Just like I have to pay bills, they have to pay bills,” she said.

But they can also use the money they’ve earned to buy rewards, like candy for $2 or a homework pass for $3. Lunch with a friend runs $5, while lunch with Miss Lattimore is $7. The highest ticketed — and most coveted — reward is “being teacher for a day” for $30.

“They do have to budget for that one, but they love the responsibility of taking attendance, telling them when to get in line, when to get up, things of that sort,” Lattimore said. As part of their learning, Lattimore never allows her students to spend more than they owe.

Brittany Sales said her daughter Marlii, who was in Lattimore’s class last year, never really discussed money before she started learning about it in class.

“She just thought it grew on trees and she could spend it,” Sales said. “We literally learned so much from how she taught it and to how we could tie it into at home,” Sales said.

Now Marlii saves the money she receives on her birthday and holidays, and budgets her spending for wish list items, including a new pair of Nikes.

“It took me like three months to save up,” Marlii said.

The success of her creative teaching has also provided something of a windfall for Lattimore, who has generated brand collaborations and monetized her videos through TikTok’s creator program.

“This past year I made six figures, which is insane, because my teacher salary is not even half of that,” Lattimore said.

With over 25 million likes and 793,000 followers on TikTok, Lattimore’s fans often comment on the hilarious reactions from students complaining about having to spend their money responsibly and the heartwarming care Lattimore gives them. In videos, she can be seen handing out everything from hugs, to extra snacks, to toothbrushes to her students.

Fans have also sent school supplies, books, care packages and snacks to her classroom.

Lattimore said every day she gets excited to go to work for just one reason: “It’s going to sound so corny, but it’s them.”