Starting in young adulthood, one of the most important life skills is managing your money. This starts with a good understanding of how capital works, how to budget and save, and how to invest and make a nest egg grow.

But there’s an access gap in setting up young minds for financial success. As compared with white high school students (one in nine of whom had access to finance education), only one in 20 students from Black and Brown schools had the same access, one of the root causes of the racial wealth gap in America.

And this gap plays out in myriad ways.

According to the Prudential Financial Wellness Census of 2020, more than half of Black Americans cited an annual household income of less than $30,000, compared with 36% of white households. Additionally, 25% of Black Americans reported being unemployed, compared to 19% of white Americans. The median debt-to-asset ratio of Black households compared to white households is 46.8% to 29.5%, as reported by the Employee Benefit Resource Institute.

For nearly 50 years, Prudential has been working diligently to counteract this paradigm and help Black Americans build generational wealth from an early age. A major pillar of Prudential’s strategy involves fostering the financial literacy and professional pathways for historically Black colleges and universities. As Portia Fields, VP of Business Development for Blueprints to Black Wealth at Prudential, tells us, meeting young minds at the pivotal point of their lives is especially critical because it’s when they’re forging paths, building connections, and creating habits.

“We want to be a global leader by always expanding access,” she tells The Root, “by providing financial security for all.” The company has dispersed nearly $5 million to HBCUs across the country, including Florida A&M, Atlanta’s Morehouse College, Washington DC’s Howard, and Virginia’s Hampton University.

Prudential has a particularly strong partnership with Hampton which goes back more than 20 years. Over that time, the company has contributed nearly $2 million to the university and underwritten the largest space in their business school, the Dr. Sid Credle Hall, providing students with an early boardroom experience.

Over the lifetime of the partnership, Prudential leaders have come into Hampton classrooms for 6 guest lectures (with the goal being 12) and recruited 25 Hampton students to join the Prudential team as interns or full-time associates.

“Prudential execs even come to our homecoming games!” Hampton University President Darrell K. Williams says. “Not only has Prudential lent their support in terms of internships and jobs, they have skin in the game. It’s a strategic partnership that is both timely and impactful for our students and something that contributes positively to the student experience.”

Two years into his tenure leading the university, President Williams, Hampton class of ’83, has enthusiastically set out a plan to give his students the number one student experience in America, and his team has already achieved so many of their goals.

Enrollment and applications are up (from 800 to 1,200 students in the freshman class and from 13,000 to 17,000 applications). All of the school’s eligible disciplines seeking accreditation (including architecture and aviation) have achieved it. Hampton also launched a year-long, accelerated MBA program that students can take advantage of online and joined a regional athletic conference allowing their students to compete on a whole new level. Williams has also prioritized infrastructure improvements enhancing day-to-day life, like renovating residence halls, upgrading their performance theater, and increasing their broadband capability from 10G to 100G.

Additionally, the partnership between Hampton and Prudential is going strong. “The entire collaboration is about building and growing a wealth mindset within our student body,” Williams tells us. “The support of Prudential has provided them early exposure to financial autonomy.”

One of the ways Prudential encourages HBCU students—at Hampton and beyond—is by simply enabling them to stay in school. With nearly three in five HBCU students coming from low-income families, the dropout rate of Black and Brown students is especially high. Only 45.9% of Black students at public four-year institutions complete their degrees in six years, as the United Negro College Fund reports.

Last year, to counteract this effect, Prudential partnered with the Student Freedom Initiative to flagship the HELPS program, which assists students in minority-serving institutions right when they need it most — when encountering a costly life obstacle that may prevent them from returning to college. University guidance departments receive these microgrants and allocate them to students at funds up to $1,000. These grants are accompanied by student sessions on how to budget, save, and manage money, which Fields reports as a success. “Especially through the financial education seminars, this program starts to shape the mindset and habits of students.”

Another cornerstone of the Prudential and Hampton University partnership is the Prudential Fellows program, which furnishes educational programs, mentorship, technological assistance, and scholarship dollars to participating universities. “The fellowship places students so far ahead of their contemporaries,” Williams tells us. “They’re brought to Prudential headquarters, go out to corporate dinners, and have conversations with Prudential leaders who’ve worked there for 20 years, often in the C-suite.”

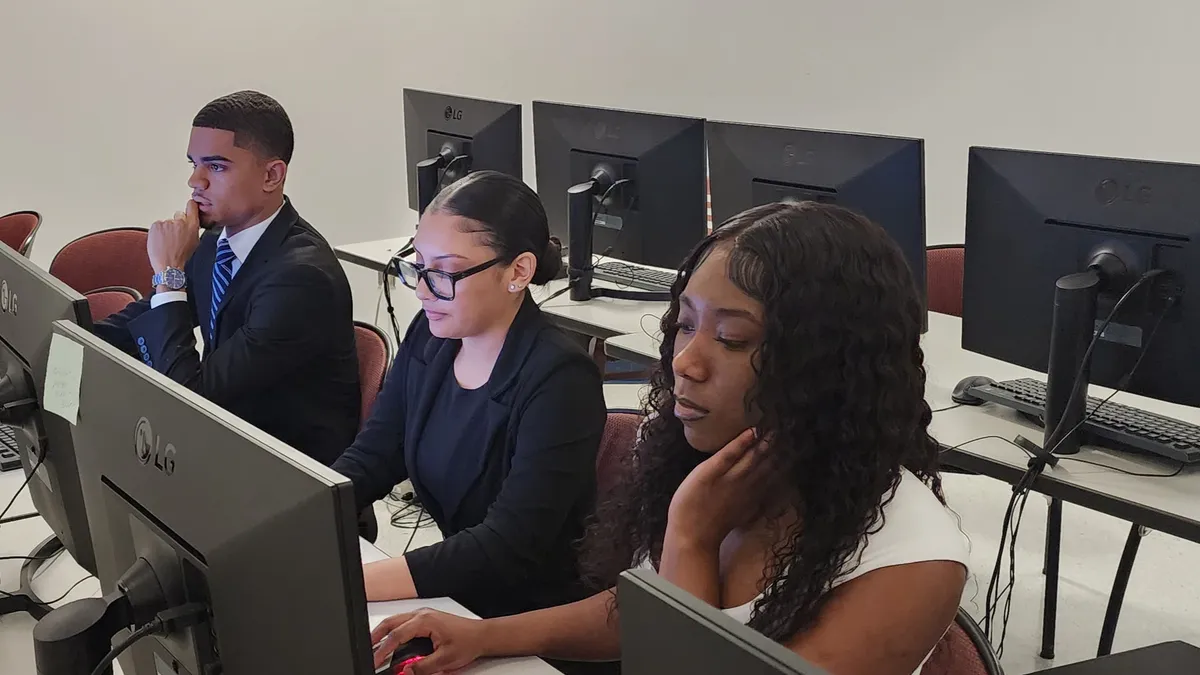

As another aid to a growth mindset, PGIM, the global asset management business of Prudential, supports Hampton Business School students with costly Bloomberg terminal subscriptions, allowing them to track and analyze market data in real time, including for university programs like Hampton’s Investment Club, where students manage a fund of up to $100,000. Only 39% of Black families own equities, compared with 66% of White families, as reported by the Pew Research Center, so this exposure is a golden opportunity to teach young adults the ins and outs of growing a nest egg.

“The relationship we’ve built with Prudential has strong roots that are growing stronger every day,” Williams attests. In fact, the company’s support aligns perfectly with Hampton’s slogan: “The standard of excellence, education for life” as the financial knowledge provided by this partnership will persist long beyond graduation day.